Did you know email has been around since the early 1970’s?

Ray Tomlinson, an American computer programmer, holds credit for sending the very first email back in 1971. Although the second email ever sent is lost to history, it would come as a surprise if it wasn’t a marketing email of some sort.

Insurance email marketing remains one of the most potent marketing strategies for agents. Direct and effective, insurance agents who are not leveraging the power of email are leaving money on the table.

Even with the rise of alternative marketing channels such as social media, podcasts, and digital marketing, email consistently ranks as the most effective marketing channel.

In our guide, we intend to help independent insurance agents like yourself develop and deploy an effective marketing campaign. Each step in the process has been broken down in the table of contents.

After reading this guide, you will have learned:

- How to create successful emails for insurance sales

- How to build a targeted email list of your customers and prospects

- How to regularly reach your audience

If this sounds good to you, keep on reading the ultimate guide to email marketing for insurance agents.

Table of Contents

- PART 1 - Email marketing for insurance agents

- PART 2 - The transformation of the sale process

- PART 3 - Anatomy of a marketing email

- PART 4 - Building your email list

- PART 5 - Salivating subject lines

- PART 6 - Writing successful content

- PART 7 - Creating a call to action

- PART 8 - Leveraging landing pages

- PART 9 - Testing and tweaking

- PART 10 - Software to succeed

- PART 11 - BONUS solution: insurance email marketing

Email Marketing for Insurance Agents

For some industries, technology has spelled the demise of traditional sales channels. Take for instance the travel industry. Between 2000 and 2014, the number of travel agencies was cut in half as the ability to book airline tickets, hotels, and rental vehicles moved online.

Insurtech - There are comparable threats confronting insurance agents as well. Companies such as Ladder and PolicyGenius have taken shots across the bow of the independent insurance agent. Looking to replace or cut out the middleman, insurtech startups have been targeting the insurance industry for the better half of a decade. Although there has been success with these new entrants, technology more than likely will bolster the role of the independent insurance agent.

Let’s consider real estate agents for a minute. Like insurance, the real estate industry believed technology would end the role of the independent, local real estate agent. But we haven’t seen real estate agents go away. In fact, it’s a growing business that technology has helped. The National Association of Realtors has found technology-based realtors are earning three times as much as their non-technological counterparts.

As opposed to putting realtors out of business, they are actually becoming more efficient and profitable. And so too will insurance agents who embrace technology. Unfortunately, the insurance industry is slow to change – but this is where your opportunity lies.

Insurance Email Marketing - There are many technological advancements insurance agents have at their disposal today. Websites, CRM systems, and mobile apps just to name a few. Just like real estate (and dozens of other industries) those who successfully deploy email as a marketing tool are the agents who are not only surviving the technology revolution but thriving.

You would think every insurance agent would be using email marketing to grow their business. But most are not. In fact, 74% of insurance agents say they’ve never even tried email marketing.

So why are only 26% of insurance agents using email to market their agency?

Simply put, a successful email campaign requires a lot of upfront energy, ongoing content development, and regular monitoring. For many insurance agents, it is just too much to take on; even if the statistics prove email marketing is worth it.

And of the 26% who do use insurance email marketing, a good portion of them are doing it wrong. Many have yet to understand how the sales process has changed, what makes a great email, or how to even build an email list. Fortunately for you, we’ve created this guide to change all of that!

The Transformation of the Sales Process

Over the past few years, how products and services are sold has gone through a transformation. At the center of this recent, dramatic sales shift is technology. Whether selling complex enterprise software or something as simple as a Swiffer®, technology has forever changed the sales process. And yes, this includes the salve of insurance.

There are two significant ways technology has altered the way insurance (and pretty much everything else) is sold as we know it.

Instantly available information - Technology has unleashed information once held onto by companies and sales teams. Gone are the days of customers asking their insurance agent for basic information. Instead, if consumers have a question, they simply reach in their pocket and search online. This means consumers will look for insurance agents who are providing value long before they may ever speak to them in person.

The consumer-driven sales process – The transfer of information once held by insurance agents to becoming readily available online has shifted who now controls the sales process. In the past, it was the consumer who had to come to the insurance agent to learn about your products, their benefits, and even the price. The old dynamic meant it was our responsibility as their salesperson to guide the consumer down our sales path from discovery to sale. Today, it is now the salesperson’s role to guide follow the customer down their own path as they now decide when and how they purchase goods and services.

Acknowledging and understanding changes in the sales process is a key component to creating a successful email campaign. When creating your next marketing email, seek to add value to your prospect and guide them to their next step in the sales decision process, which we will tackle later.

Anatomy of a Marketing Email

Earlier we alluded to the amount of energy and effort required to create a successful email campaign. There is no avoiding it. Success with insurance email marketing requires a significant commitment from you. However, like most successful endeavors, taking a step-by-step approach will help reach your goals much faster than jumping in with both feet.

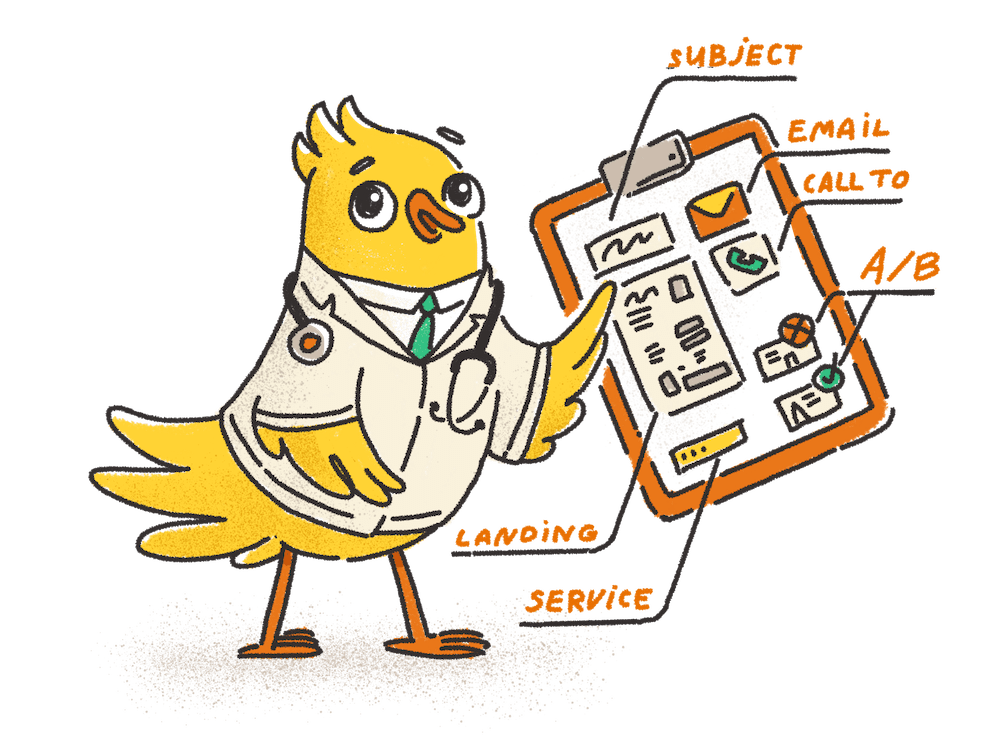

So, what makes up a successful email marketing campaign? Let’s explore each component we need to address before we can hit the send button.

-

Email list – Simply put, you must have someone to send your emails to. But not just any list, because success or failure ultimately hinges on building a targeted list of potential prospects.

-

Subject line – Your audience needs a reason to read your email. Without a mouthwatering subject line, your email won’t even get off the starting line.

-

Email body – This is where the rubber meets the road. The wrong message can put your email into the spam folder forever, while the right message can lead to sales again and again.

-

Call to action – An email without a decisive call to action is like a ship without a rudder. Your readers need a clear and concise next step to follow or nothing else will happen.

-

Landing page – If you are looking to direct the audience to your website, you will need a landing page. Your landing page should be clear in its purpose and welcoming to your audience.

-

A/B Testing – Learn why some emails work and others flop. By testing and tweaking, you can increase the success rate of your email marketing over time.

-

Service providers – It would be impossible to successfully run an insurance email marketing campaign without using an email service provider or automated software program.

When broken down to the core components, insurance email marketing doesn’t seem quite as intimidating. You will find many different theories and approaches that can be applied to any single element. In the end, however, you know your audience best. By listening to them carefully in your day to day course of business, you will learn what emails will resonate the most.

Building Your Email List

One of the most common questions AgentMethods receives about email marketing is “how do you get a list of people to email?” After all, you need email addresses to email to. Let us first tell the way NOT to obtain emails is by purchasing lists, scraping the internet, or renting contacts.

Your email list needs to be just that – YOUR email list. Even if you begin with just 10 or 20 emails, you can find success with an effective insurance email marketing campaign. Of course, the more qualified email addresses you have, the greater opportunity to make more sales. Here are a few ways to build a quality email list:

-

Current clients – This one is obvious. You’ve already earned your clients’ trust and sending value filled emails is expected of you. In fact, if you are not regularly reaching out to your current clients, they may be likely to go elsewhere. If you don’t have their email, call them and simply ask “can I have your email so I may send you some valuable information?” You should work toward collecting an email address for EVERY. SINGLE. CUSTOMER.

-

Prospects – If you use your CRM system to maintain prospect records, make sure to add your prospects to your email list. Too often we find insurance agents who keep their CRM prospect list separate from their insurance email marketing lists.

-

Past clients – Clients may leave for a variety of reasons. Regardless as to why they left, it doesn’t mean they won’t respond to you reaching out to them. Insurance is often a matter of catching a prospect at the just the right time. Many of your past clients may just need a nudge to return.

-

Friends and family – This may sound like insurance sales 101, but your friends and family can become your best clients and referral sources. Your emails are going to provide valuable information. While they may not need your services, your emails will ensure you remain top of mind when they – or their contacts need them.

-

Centers of influence – Make sure all your potential centers of influence are on your list. This includes accountants, attorneys, and anyone else who works with your target audience. The key is to make sure your name is the first they think of when their clients ask about the types of products you sell.

-

Lead magnets – On your website, offer a relevant and actionable lead magnet in exchange for an email. A lead magnet could be a useful checklist, a timely white paper, or other downloadable document.

Your email list is a living, breathing asset. This means it needs to be nurtured and cared for, otherwise it will slowly shrink and wither away. Be sure to prune your list of invalid email addresses and make sure those who unsubscribe are added to a do-not-email list to avoid violating CAM SPAM laws.

Salivating Subject Lines

Insurance email marketing starts with a great subject line. After all, an email that isn’t opened is a wasted opportunity. Coming up with just the right subject line can often be the most agonizing part of the entire email marketing process. Even the best copywriters in the world can struggle with them. But there are two tricks you can use to create your salivating subject line.

Create 25 subject lines – For each email you are creating, write down 25 possible subject lines. The first 5 to 10 will be easy. The last few will be tough; but that is usually when the magic happens. If you can produce 25 subject lines, the right one will almost always appear somewhere in the list.

Watch your email inbox – Every time you open a marketing email in your own inbox, take note of the subject line used. Odds are there was something that caught your eye. Over time, you will also start to see a pattern of subject line “types,” phrases that are used repeatedly.

Sometimes, no matter what you do, there will come a time where you will have writer’s block when it comes to developing a subject line. Fortunately, there are some tried and true phrases that can help increase the number of emails opened.

Here are five writer’s block busters you can try:

#1 The how to approach

For educational topics, the ‘how to’ subject line is a great way to generate more email opens. Here are two great insurance specific examples:

- How to choose the right Medicare supplement plan.

- How to get the most life insurance for the lowest cost.

The subject lines tell your audience what they can expect to learn. Just make sure your content delivers on your subject line’s promise.

#2 Use numbers

‘How-to’ subject lines work great. But research shows adding numbers to your subject line can improve open rates by more than 50%. When your content allows, specify how many items the reader will read about. For example:

- 3 steps to prepare for this year’s open enrollment period

- 4 ways to save on your homeowners’ insurance today

The numbers tell your audience your content will be educational and easy to consume. A win-win for everybody. Email marketing for insurance agents is a numbers game and using numbers is one way to improve your odds.

#3 Ask a question

Humans are curious creatures and using a question is a great way to pique someone’s curiosity. Nearly any topic can benefit from a question subject line such as:

- Do you check your retirement balances this often?

- Are you ready for the upcoming tax law changes?

Make sure your content clearly answers the question posed in your subject line. As an added bonus, solicit even more curiosity by hinting at a new question you will answer in an upcoming email.

#4 Make an announcement

The insurance industry is ripe with changes, deadlines, and important updates. Keep insurance email marketing simple by using these as an opportunity to reach out to your audience and keep them up to date.

- Congress approves new tax bill; here’s what you need to know

- Mark your calendar with these important Medicare enrollment dates

Over time, you will become known as an authoritative source of insurance information. This can be especially valuable for your centers of influence.

#5 Surprise subject lines

Add a little spice to your subject lines. Surprise subject lines are unexpected in the insurance industry and can help boost your open rates.

- Jennifer Lopez insured her derriere for how much?

- You won’t believe how much life insurance this athlete has

Because of the uniqueness of surprise subject lines, it is difficult to quantify their general expected success rate. Using the surprise approach will likely result in exceedingly great or depressingly low open rates; so be prepared.

Even though subject lines may be short in length, they will go a long way toward your insurance email marketing campaign’s success. This is the one step in creating marketing emails that will require a disproportionate amount of time compared to the final result.

Writing Successful Content

You’ve built a list (and checked it twice) and are ready to share the wealth of information you’ve gathered over the years. When putting pen to paper to write a marketing email, the natural tendency for many insurance agents is to begin telling their audience how great their products and services are.

But here’s the thing… your audience doesn’t care.

Remember, the sales journey has shifted from your control as the insurance agent to the consumer. This means your email copy must be focused on the consumer, not you. This is when you want to step back and take a deep breath. Then use the following email copywriting principles to write great emails.

-

You are a guest in their inbox – Email is a very intimate and invasive form of advertising. Every email you send is by way of the recipient’s permission. They have invited you to their “home.” Be respectful and use your manners. This includes using proper salutations, signature closes, and language.

-

Keep it short – There are statistics showing long-form emails can return tremendous results. However, those emails are best suited for one-time purchases where a customer-salesperson relationship doesn’t exist. Emails less than 350 words tend to perform best in our industry. It’s okay to go longer, but only if every line in your email is adding value.

-

Speak to one person – Even though you may be sending emails to hundreds of addresses, write your email as if you are speaking to a single individual. The result will be a more conversational and intimate tone that will better connect with the reader.

-

It’s all about the reader – Avoid using the words ‘I’ or ‘we’ except in a very limited capacity. Instead, use the ‘you’ pronoun as often as possible. Remember, your audiences care more about themselves than you, and your content needs to be reflective of that fact.

-

Use visual cues – Within your text, use bullet points and lists to make your content easier to consume. Emails with paragraphs upon paragraphs of text will soon find the trash bin.

-

Limit links – Email service providers like Gmail and Yahoo! may flag emails with too many links. Two or three links are all you need within your email. They should be strategically placed near calls-to-action (see below) and in your signature close.

-

Add an image – Not only are we curious creatures, we are also visual ones. Adding an image or two is a great way to draw readers into your copy. But don’t use too many images and stay away from fancy email templates. Many email services, especially Outlook, will have images turned off. If you have many images in your email, they will appear disorganized and confusing to those users.

Just like our tip about subject lines, save marketing emails you receive where you find yourself reading all the way through. Notice how they are conversational and put you at the center of conversation.

Creating a call to action

Even if you wrote the most captivating and awe-inspiring insurance marketing email, nothing would likely happen. That is, unless, you tell your reader to act. We know the best email campaigns will have response rates in the single digits. But without a call-to-action, your response will inarguably be zero.

When most of us think about a call-to-action, phrases like “call now” or “sign up today” likely come to mind. But a call-to-action should be nothing more than simply getting your audience to take the next step. Early stage emails may ask your audience to visit your website or simply look out for your next email.

After trust builds and prospects get deeper into your marketing funnel, you will then begin to make more specific asks of them. This is when you will ask readers to join your newsletter, complete a questionnaire, or schedule a meeting with you.

Regardless of what your call-to-action is, it still must be compelling enough to push the reader to take action. There are dozens of different calls-to-actions you can create. But the best ones boil down to tapping into two different social cues.

Speak as “me” – Use the reader’s inside voice to solicit an action. Phrases can include “show me my premium” or “take me to the savings.” This approach makes the reader feel like they are acting on their own instead of you telling them what to do next.

Speak as “us” – Some readers may not be ready to act on their own. But they may be open to taking the next step together with you. Using phrases including the word “us” invokes a sense of partnership. Instead of using sterile phrases like submit or click here, bring the reader with you using phrases like “talk to us” or “let’s schedule a meeting.”

There isn’t one sure fire call-to-action that will work with every person on your email list. You will want to try different phrases to see how your specific audience responds. This is where insurance email marketing can be as much an art as a science.

Leveraging landing pages

Emails can stand on their own as a marketing tool. Landing pages too can be used to bolster sales all by themselves. But if you pair the two together, you’ll end up with a powerful one-two punch! Of course, you will need a great call-to-action to direct your readers to a landing page to take the next step (see above).

Most regular website pages have many different elements and encourage visitors to explore. Landing pages, on the other hand, are stand-alone webpages with a single, very specific goal. Your landing page’s goal may be to have the visitor:

- Request a quote

- Sign up for your newsletter

- Download a free guide or checklist

- Schedule an appointment with you

Regardless of the industry, successful landing pages all tend to follow the same general design elements. When creating your landing pages, use these guidelines to help increase your conversion rates:

#1 Be clear and concise

Make sure your copy on the landing page is exceptionally clear. Do not leave any room for ambiguity and make it easy for your visitor to know exactly what to do next. We want the visitor to act as soon as possible. The longer or more complex your copy, the higher the likelihood your visitor will leave your page.

#2 Ask for the minimum

If you are using a form, ask for the absolute minimum information you need to fulfill the insured’s request. Studies have shown the more fields a visitor is asked to complete, the fewer completed forms you will expect to receive.

#3 Remove any leaks

Your landing page should only have one actionable element to it – the submit button (with better call-to-action language of course). Remove any links or navigation buttons from your landing page as these only serve to distract your visitor.

#4 Stay above the fold

The fold is the point on a website page where a visitor will need to scroll to continue reading. Landing pages work best if you can include all your copy, form fields, and action buttons above the fold.

#5 Keep it simple

Keep your images small and your text large. When designing your landing page, take cues from billboards you might see alongside the highway. Text should always take precedence over imagery.

#6 Continue your email

It was your email which brought your reader to the landing page. Make sure the landing page has the same tone and feel. Even better, thank the visitor for taking the next step asked of them in your email on your landing page.

It is easy to over think landing pages. By keeping them simple and to the point, you will help your visitor take the next step in their journey of the purchasing process. As you are visiting websites, make note which ones fit the definition of ‘landing page’ and see how they include many of the six qualities above.

Testing and tweaking

Image idea: Character dressed as a hero fending off ‘insurtech’ with his shield.

Always be testing, always. Yes, it is that important. Testing is what separates the average insurance agent from the most successful. Think about it… over time you have learned which sales techniques work and which ones don’t. This is because you’ve been “testing” closing strategies your entire career.

To maximize your insurance email marketing, you will need to constantly test to learn which techniques work and which ones don’t. Sometimes the smallest changes can make the biggest impact. But you’ll never know unless you do what is called A/B testing.

A/B testing is simple. Split your list in half and send the same email except with one difference. What differs is up to you as there are dozens of different elements and combinations that could be affecting your success rates.

These are a few elements you can test and learn which ones perform better for your email campaign:

- Subject line

- Calls to action

- Image content

- Length of email

- Number of links

- Size/type of font

- Number of images

Is important to only change one element at a time. If you change more than one, such as a picture and the subject line, you will not know which one contributed to the resulting outcome. As you document your findings, over time you will narrow in on a formula that performs best for your targeted audience.

Software to Succeed

Once you’ve decided to commit to insurance email marketing, you will need a variety of support services. Although you could send emails manually using your current email program, email marketing is a numbers game and sending hundreds or thousands of emails just won’t work using Outlook or Gmail.

Instead, you will need service providers who can assist with every aspect of your email campaigns. Fortunately, there are many high-quality companies ready to help you.

-

Monitoring tools – What good is a great email if you can’t track the results? Many email service providers include some level of tracking. To really understand your email campaign’s performance, consider using services like GetNotify or Campaign Monitor, or AgentMethods’ email marketing platform. Results are interactive and can be provided instantly.

-

Testing tools – If you want to automate your A/B testing in lieu of manually tracking what works and what doesn’t, investigate one of the many testing services. Companies like Litmus and Reach Mail are built specifically to streamline the testing process.

-

Landing page builders – If you manage your own website or enlist the help of a webmaster, you can design and implement your own landing page. But there are many companies like OptinMonster and Unbounce who can have landing pages ready in minutes if you would rather have an expert handle it (or use the landing page builder built into AgentMethods).

-

Email service provider – You will need a provider who can send thousands of emails when you want them sent. Some of the more popular companies include Constant Contact, Send in Blue, and Mail Chimp. At their core, these companies excel at sending emails while providing average add-on services like those already covered above.

As you can see, there is an ocean of tech companies waiting to help launch your insurance email marketing. But there are two major hurdles you need to be willing to tackle to be successful:

#1 You must create the emails

As great as the above services are, successful insurance email marketing campaigns will require you to come up with the content. This includes creating calls-to-action, email copy, and the all-important subject line.

#2 You must commit time

For most insurance agents, their time and energy are better spent in front of prospects and clients – not in front of a computer screen. Each service will require time to set up, manage, and maintain.

Insurance email marketing requires your full commitment to be successful. Dipping your toe into the email marketing waters simply won’t work. Insurance agents who have spent the time, energy, and money necessary have been widely successful. So are those who have found all-in-one solutions who can manage the entire process from start to finish

Bonus Solution: Insurance Email Marketing

Our goal in the ultimate guide to email marketing for insurance agents is to lay down a solid foundation from which any insurance agent can begin building their very own successful email marketing program. But, for those agents who would rather sell insurance than write emails, we have a solution…

AgentMethods Pro Email Marketing!

With AgentMethods, we’ve automated the entire insurance email marketing process. Generate new leads, increase referrals, or cross-sell products to current customers with a few simple clicks of your mouse.

We have a library of carefully curated emails specifically created for insurance agents just like you. Create three months of email marketing in less than an hour. All you need to do is choose the campaign you want to run and schedule your delivery time.

Each month you can send two personalized email campaigns to your list. We’ll provide the rest, including:

- Imagery

- Email copy

- Subject line

- Landing page

And when a new lead comes in, we’ll instantly notify you via email or text. It’s that easy!

AgentMethods has helped thousands of insurance agents grow their business. Let us help you grow yours!